You want the best for your clients and customers but in the face of recent events in the Australian Financial Services Industry, the need for a heightened focus on compliance is inevitable. Achieving balance between the two in the face of growing competition is a major challenge facing financial services organisations today.

Related:

We sat down with Steve McEwin from Beyond Bank, Kim McLaren from Indue, and Rebecca Engel, FSI Industry Lead from Microsoft, to discuss the best strategies and methods to bridge the gap between regulatory compliance and customer experience.

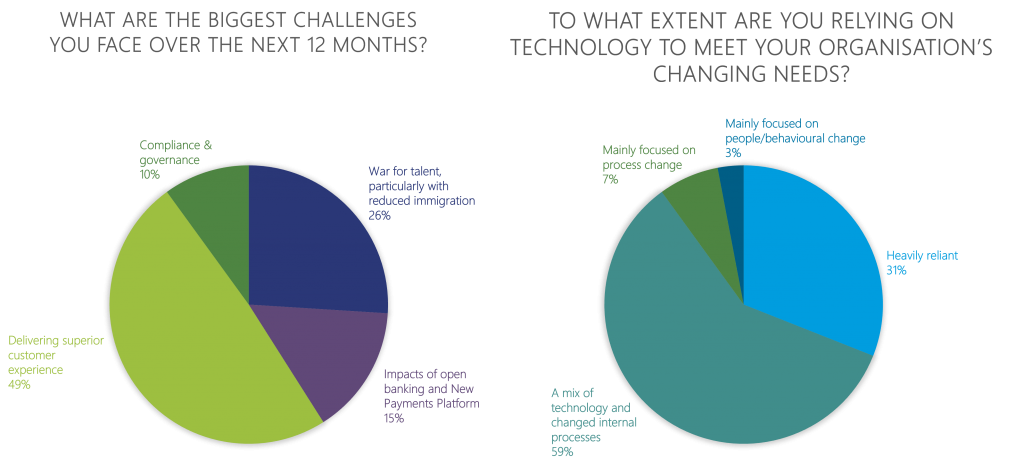

Before we began, we asked our audience to share their key pain points with this challenge – this is how they answered:

The results show that delivering a superior customer experience is at the forefront of near-term challenges for Financial Services organisations with a strong focus on blending technology solutions and streamlined processes to deal with changing business needs.

Here are the key findings from our discussion.

Accept it’s a balancing act

Kim McLaren

“It is a tricky question to try and balance the customer experience and regulatory reforms. It’s working out which of those regulatory reforms can really become a differentiator – can you differentiate anything within that regulatory reform or is it all vanilla? So with some of our changes we’ve tended towards trying to invest a bit more time to make it different.”

On a surface level of principle, we may understand that satisfying regulatory compliance and customer experience needs is a balancing act.

However, to accept the balancing act, we have to understand that we can’t always ‘win’. Variables with technology, speed of regulation update, and maintaining intradivisional satisfaction (eg, ensuring your legal team isn’t being too restrictive or your marketing team isn’t being too bold), all impact what you are able to achieve.

The cost of not embracing the balancing act is that you lose energy to get the changes you need. When deprived of this energy, the natural reaction is to take the path of least resistance.

However, the path of least resistance – while safe and less stressful – isn’t likely to lead to customer satisfaction and growth.

So be prepared for the long haul. Take into account the adjustments you may need to make in the short-term so you can focus on finding the best solutions to achieve business critical outcomes in the medium to long term.

Lastly, try to be consistent. If you can regularly achieve a base level of satisfaction from your stakeholders, you’ll find you’ll continually veer towards successful outcomes.

Define your issues before choosing the tech to solve them

Steve McEwin

“If you want technology to work, it’s got to be there to support.”

While the right technology is life-changing, the wrong technology can be costly, time-consuming, and underutilised.

What separates ‘right’ from ‘wrong’ tech is simple:

Does it solve a problem that my business faces?

But before you get to that question, it’s critically important to define what that problem is. For some issues, the problem is self-evident, while for others, it may take more examination.

As an example – if customers are reporting that they are dissatisfied with the length of time it takes to get in contact with support staff, you could:

- Employ technology that allows support staff to get across calls more quickly, or

- Spend time innovating your current systems so customers never have to get on the phone at all

In this example, the problem behind the issue might be that information that would have ended the need for a call wasn’t on your website. Or it could be that a chat service on the website has broken down, or a myriad of other issues.

That’s why it is vital to properly research and define your issues before searching for the tech to solve them or you could be solving for the wrong issue.

Good processes lead to better customer experiences and stronger compliance

Steve McEwin

“Refining and automating the back-end decision making processes and document prep, and populating of front-end processes with open banking data, will streamline the application process. So it’s all going to become much, much faster for our customer and that also results in a lower cost for us.”

As different as the goals are between customers and compliance (one for fast and convenient service, the other for confidence that regulations are being met), they can both be satisfied with good processes.

What defines a good process is often confused. It’s not about depth, breadth, speed etc, but instead, a good process relieves the burden of thinking and creates repeatable, reliable actions.

For example, if regulations required that no document should have a spelling error, you might have a team of worried editors constantly at work – or you could implement a reliable spellcheck tool.

When a well-engineered process removes the need for energy to be focused on repetitive and time-consuming tasks, it simultaneously provides the opportunity for that energy to be used elsewhere. This might allow your support staff to manage customer requests more quickly, or help ensure you’re meeting regulatory requirements confidently without endless reviews.

Gather VOC data as a part of your BAU and process design

Kim McLaren

“Some of our compliance and internal systems weren’t up to scratch, and we spent considerable time addressing this. We did notice a reaction from customers. I think it needs to be a constant focus that you just can’t take your foot off the pedal. You really do need to do both together because your customers will pretty much tell you that they’ve been forgotten about and you need to keep them in focus.”

VOC (voice of client/customer) data is a critical resource for any business. While customers might not tell you how to innovate for them, they can point out where gaps exist in your current services.

Unfortunately, the gathering of this data is often side-lined for other projects, or left as a quarterly or annual campaign.

Many organisations, particularly those that are digitally based, are keeping this front of mind constantly and are using design thinking to combine the needs of the customer, the possibilities of technology and the compliance requirements for business success. Successful innovations rely on some element of human-centered design research (or VOC) while balancing other elements. Design thinking helps to achieve a balance across competing demands by finding the sweet spot of feasibility, viability, and desirability, all the time considering the real needs of people.

With the right approach and technology support you can source, track, store, and use voice of customer data efficiently and effectively. Integrating this as a BAU practice will surface crucial insights, allow you to course correct more quickly and help you to stay ahead of your competitors.

Promote transparency, break down silos and create consistency

Kim McLaren

“We don’t have huge overheads, but the governance itself is an overhead. What we wanted we just didn’t have – transparency. How do you know if everyone is doing what they’re supposed to be doing at the right time and in a consistent way?”

Siloing – or the lack of communication and understanding between teams in a business – has a significant impact on business operations.

Businesses can end up using several overlapping solutions (which can get costly), multiply work or have it double-handled, or create an internal process and language divide (eg, develop separate processes to create the same outcome or use the same term in different capacities across teams).

Even something as seemingly small as file locations can mean the difference between hours wasted searching for a document and being able to find it in seconds.

Transparency – openly sharing and making available information, practices, processes, and insights across teams – is a way to uncover potential errors, and inefficiencies, as well as create a consistent and updatable framework of ‘how things are done’ and where things are.

Visibility and connection across teams and departments creates reliable work and information flows leading to better decision making, streamlined operations and the ability to place resources and effort where they are needed most.

Your result is an end-to-end understanding of what’s happening, who’s responsible, and why which is critical when balancing activity for compliance with delivering a great customer experience.

In the new world of hybrid work arrangements the need to remove siloing and create common understanding and communication across the work environment has never been more critical.

Remember teams are at the forefront of cultural change

Steve McEwin

“Change is tricky because if you are enforcing change, there’s often inertia from people who are resistant to it. You hear; ‘because we’ve always done it that way’, ‘we tried that before and it didn’t work’. The temptation can be to back off and it’ll be fine. I prefer to start with the view that people come to work to try and do a good job so let’s help them do that.”

Change is an inevitability of bridging the compliance and customer experience gap. But change isn’t always readily accepted.

Some employees can get stuck in their ways, while others are always looking to try new things. Some will worry their livelihood is being threatened, while others might see room to grow and take on opportunities.

So when you’re bridging the gap, it’s important to take those human experiences into account. Listen to and involve your people as early as you can, train them, empower them, and let them be part of the process.

Because even if you can’t excite them about changes, you can have them engaged with the process and contributing to solutions and outcomes. This requires planned, ongoing actions, adjustments and feedback well after changes are made.

Bridging the regulatory and client experience gap is a major challenge but all agree that those organisations who get it right are setting themselves up for strong growth and sustainable business success.

What you should read next:

- Whitepaper: What now? A guide for financial services leaders in a disruptive time

- Whitepaper: Redefining Risk Management in an Era of Data and Disruption

- Whitepaper: Customer Experience Trends in Financial Services

By Karen Freeman

With 15+ years’ experience working in the technology industry, Karen’s expertise is in creating business value for Sensei clients off the Microsoft Platform, ultimately assisting our clients to improve the way they work.